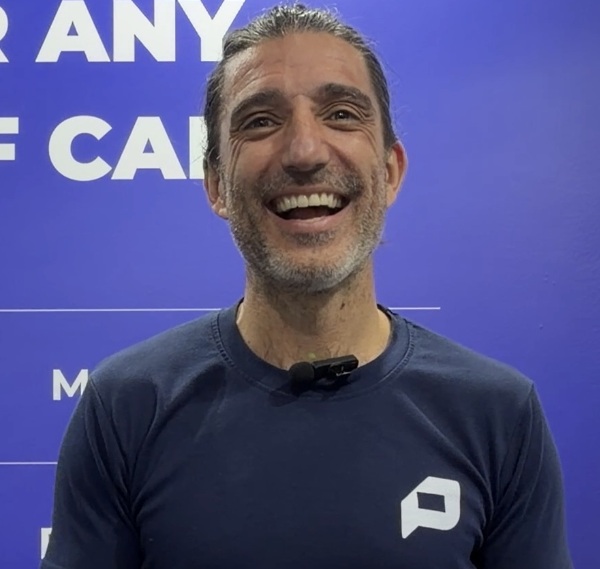

SINGAPORE, November 18, 2025 – At the Singapore FinTech Festival 2025, amid packed halls and a decade of SFF momentum, Paymentology CEO Jeff Parker saw the event with fresh eyes. It was his first time attending, and the scale of innovation left an immediate impression. “The quality of the exhibitors, the innovation around the halls — we’ve had excellent conversations. We’ll definitely be back next year,” he said.

Paymentology is a leading next-generation issuer processor, empowering fintechs, digital banks, SME/commercial and retail banks to effortlessly launch and manage innovative payment solutions on a global scale.

In an exclusive conversation with AsiaBizToday, Parker shared how Paymentology’s superior multi-cloud platform, and enhanced real-time data, positions itself as a leader in the payments industry.

Global Ambition, Local Precision

Paymentology’s value proposition rests on an elegant promise: enable banks and fintechs to launch anywhere in the world Jthrough a single issuing and processing platform. The mechanics behind this are more complex than the simplicity they offer clients. The company operates on a single global codebase and unified APIs, so partners integrate once — then expand into new geographies without building everything from scratch.

But Parker is quick to acknowledge that payments is never a one-size-fits-all business. “Not all markets are the same,” he noted. After establishing a global foundation, Paymentology fine‑tunes the experience to meet local regulations, domestic network requirements and customer realities. In markets like the Philippines, that means integrating directly with BankNet to ensure domestic routing. In Saudi Arabia and the UAE, it means deploying cloud infrastructure on‑soil to comply with data residency rules.

“It’s really about starting global and adapting locally,” Parker summarised.

From Processing to “Smart Processing”

Where Paymentology is pushing the envelope is in what Parker calls “smart processing.” Traditional processors merely authorise a transaction. Paymentology wants to go further — using data to anticipate behaviour, flag anomalies, and even guide client growth strategies.

“We’re moving from reactive decision-making to being proactive,” Parker explained. By weaving together real-time signals, long-term patterns and insights from clients across 65 markets, the company can help banks anticipate fraud, understand customer behaviour and make better decisions earlier in the cycle.

A digital bank in APAC, for instance, may benefit from transaction trends spotted in Latin America or Europe. That global cross‑pollination of insights is a strategic advantage Paymentology believes few others can replicate.

APAC’s Influence on Global Payments

Parker’s respect for the Asia-Pacific region is clear. The diversity of payment methods—QR codes, real-time transfers, e-wallets, domestic networks—has forced APAC markets to innovate faster in interoperability and orchestration than the rest of the world.

“What this region has led in is flexibility,” Parker said. “Taking different propositions and stitching them together so the customer doesn’t see the complexity underneath.”

He believes this mindset is now spreading to Europe, Africa and Latin America as global payments become increasingly fragmented.

Innovation at Global Scale

Operating in 65+ markets means Paymentology must innovate while staying deeply sensitive to local context. The company’s approach has been to build a standardised platform with deep configuration layers, making it adaptable to cultural, regulatory and product differences without fragmenting the technology.

Africa, for example, leapfrogged legacy banking and went mobile-native early. Paymentology built new features for those markets — then rolled them out globally. “It’s always that balance between local and global,” Parker said.

The Rise of Stablecoin-Backed Cards

One of the more forward-looking parts of Paymentology’s business is its support for stablecoin-backed cards. Today, the company powers several such propositions across Latin America, Puerto Rico and Asia.

“There’s a huge opportunity,” Parker said. Paymentology is even considering a turnkey “stablecoin card-in-a-box” for partners unfamiliar with blockchain but eager to offer crypto-linked products. More announcements are expected in 2026.

Singapore as a Launchpad

Paymentology does not yet have a large presence in Singapore, but Parker views the city-state as a strategic hub — both for ideas and for expansion across Southeast Asia. Key markets for the company include the Philippines, Thailand, Malaysia and Hong Kong.

With clients like GoTyme, TrueMoney, Marks and Agoda already onboarded, Parker believes Paymentology is “only scratching the surface” of what’s possible in the region.

What Will Redefine Payments by 2030?

Parker pointed to three major forces reshaping global payments:

- Tokenisation – He expects a shift from traditional card numbers to token-first payments, driven by networks like Mastercard, which plans to phase out 16‑digit card numbers by 2030. “When that disappears, legacy systems won’t work anymore. It’ll trigger major core modernisation,” he said.

- Stablecoins – Parker expects clearer use cases and broader adoption over the next few years.

- Artificial Intelligence – AI, he believes, will transform everything from fraud prediction and internal efficiencies to the creation of “data-as-a-product” offerings for clients.

Cybersecurity: The Constant Battle

With digital payments becoming universal, Parker acknowledged that cyber-risk is inevitably growing. “Cybersecurity is a huge challenge,” he said. “Tokenisation helps. One-time virtual cards help. But fraudsters are often a step ahead. We can never stand still.”

Trust, he added, is the foundation of financial services. Protecting it is non-negotiable.

Paymentology’s five-year strategy through 2030 places APAC front and centre. With rising digital adoption, growing populations and a culture of rapid innovation, the region is poised to shape the next era of global payments — and Paymentology wants to be at the heart of that evolution.

The company has also announced the roll out of PayCredit across Asia Pacific. The advanced credit ledger unifies card issuing and credit logic on a single platform, enabling financial institutions to launch tailored credit products faster, with region-specific configuration and precise control over repayment terms.

As Parker reflected, “The innovation in APAC is unmatched. We’ve built a platform ready for that future.”